Do you remember how good it was back in 2021/2022 when interest rates were at 2%?

Those were the golden days and a once-in-a-lifetime opportunity to build some serious wealth.

Buying a property was very easy at the time and many now have a distorted view of property investing. Serious property investing is uncomfortable. It is not hard, it is just uncomfortable. Coming to terms with your emotions becomes easier once you know of

- The different strategies out there

- The different finance solutions in the marketplace

- The different markets in the country

I recently started reading a book called The Tax Secrets of the Rich.

This book blew my mind especially when I learnt about the possibility of ATO bringing in higher taxes.

I felt compelled to share the amazing information that I came across about how the rich are protecting their future.

You can purchase it here.

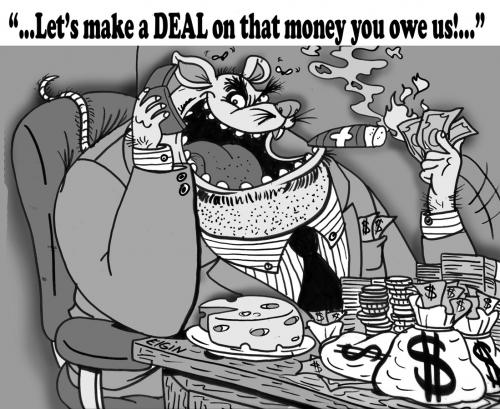

The first thing I learnt from reading The Tax Secrets of the Rich is that the ATO is BROKE!

For the year 2022, it is projected that there will be a net debt of $729 billion. That is 35% of our GDP! OUCH…

If we bring together the ATO collections and the government spending, we can see that net collections are $452 billion, with actual expenditure in 2021 of $659 billion (shortfall of $207 billion)

For 2022, the ATO expects collections to be $482 billion.

With a planned expenditure of $589 billion, a deficit of $107 billion is projected.

These deficits will continue to add up and will result in a net debt of $1.2 trillion by 2025.

The population of Australia is currently running at around 26 million people, of which only 14.2 million are registered taxpayers, so roughly about 55 per cent of the population are registered taxpayers.

Australia’s debt is estimated to rise to $1.2 trillion, by 2025. So the government will have a major challenge.

How will they repay or even cover this $1.2 Trillion Debt, given that tax revenue averages $480 billion with an average expenditure of $600 Billion?

Here is the bad news for you, me & 30% of the income-producing population.

We will be forced to shoulder this burden for many years to come.

Post-Covid-19, governments will be tasked to spend their collections wisely and must eventually balance their budget.

Covid times forced governments & central banks to print more money and take on more debt to support the economy.

However, the time to repay the debt is upon us.

Generally, a government will repay a debt by doing three things:

- Raising taxes. This may mean additional new taxes, increases in current taxes or reductions in concessions. Over the next two to three years, expect the tax revenue to increase at least 30 per cent from the current levels of $480 billion to around $625 billion.

- Reduce spending in real terms, meaning inflation-adjusted terms. Governments lose elections if they try to reduce their spending, but if they hold their spending at prior year levels and allow inflation to reduce it in real terms, this will be less noticeable.

- Printing money to increase the money supply. This will increase inflation and reduce the value of money. Those on fixed incomes or government support will struggle as their dollar will buy less. Printing more money is more palatable than reducing pensions or social welfare so instead, they will simply erode the value of your money to achieve the same effect.

How on earth will Australia’s government extricate itself from the overwhelming burden of a staggering $1 trillion debt? Even in the most prosperous years, our surplus barely reaches a meager $10 – $20 billion. It’s a drop in the ocean compared to the immense debt we face.

To even begin chipping away at this colossal debt, we would need a surplus exceeding $100 billion. Yet, let’s not forget that we are already hemorrhaging an astonishing $500 billion in expenditures.

The magnitude of this financial predicament is beyond comprehension, and it seems unfathomable that Australia will ever manage to generate a surplus substantial enough to repay its mounting debt.

In a feeble attempt to tackle this grave issue, the government’s 2022-23 Federal Budget unveiled a paltry allocation of an additional $652.6 million to the ATO Tax Avoidance Taskforce. These measures, stretched over a mere two years until 30 June 2025, are projected to yield a meager extra $2.1 billion.

This meager sum is just the tip of the iceberg in what can only be described as a feeble attempt at “Raising Taxes” – a desperate scramble to salvage our dire financial situation.

It will get worse!

For taxpayers who are employees, planning for their retirement will become more and more difficult.

For employees, tax is taken first (under the PAYG system) and they are left with the balance to work with.

Over the next 10 years and as Australia begins to repay its debt, being proactive and on top of your numbers, become more and more important. Otherwise, you may end up being in the 95 per cent who require financial assistance in your old age.

So you have to take control of your wealth. The rich use the incentives and tax offsets contained within the tax system to their fullest to minimise any tax payable thereon.

This applies both at a business level and a personal level. If you are an employee, save as much as possible to begin investing in assets that will grow in value such as real estate.

Now that you know that our ATO is BROKE, you have to be proactive to stay ahead of the system and ahead of the majority of people who are unfortunately stuck in the rat race.

I hope this blog gives you the drive and determination to build yourself a better future because we now both know, our government is falling short.

Thanks for reading.

Disclaimer: This video does not take into account your personal financial position and can not be interpreted as financial advice. The numbers in this presentation are a guide only and should be considered as such.

Have you subscribed to our YouTube Channel yet? Check it out HERE

0 Comments